pay utah state property taxes online

To pay directly to the Utah County Treasurer you must complete the online application available at the countys online office at 100 E Center. To find out the amount of all taxes and fees for your.

Utah Income Tax Calculator Smartasset Income Tax Income Tax Return Federal Income Tax

For security reasons our e-services.

. This web site allows you to pay your Utah County real property taxes online using credit cards debit cards or electronic checks. Note regarding online filing and paying. Where Do I Pay Property Taxes Utah.

Ad Submit Your Utah Dept of Revenue Payment Online with doxo. Ad Submit Your Utah Dept of Revenue Payment Online with doxo. File electronically using Taxpayer Access Point at.

PAY REAL AND PERSONAL PROPERTY TAXES. This web site allows you to pay your Utah County real and business personal property taxes online using credit cards debit cards or electronic checks. You may pay your tax online with your credit card or with an electronic check ACH debit.

General property tax information and topics. This web site allows you to pay your Utah County Personal Property Taxes online using credit cards debit cards or electronic checks. Pay utah state property taxes online Wednesday June 8 2022 Edit Use Smartasset S Utah Paycheck Calculator To Calculate Your Take Home Pay Per Paycheck For.

The Personal Property Team within the Property Tax Division develops depreciation schedules used by assessors in the valuation of personal property. The Utah State Treasurer is a state-wide elected constitutional officer and serves Utah as part of its executive branch of state government. They conduct audits of personal.

This section discusses methods for filing and paying your taxes including how to file onlinethe fastest and safest way to file. Serving a four-year term the. Online payments may include a.

Property taxes in Utah are managed through the collaborative effort of several elected county offices. Most taxes can be paid electronically. Official site of the Property Tax Division of the Utah State Tax Commission with information about property taxes in Utah.

Look Up Any Address in Utah for a Records Report. All Utah sales and use tax returns and other sales-related tax returns must be filed electronically beginning with returns due Nov. Ad Enter an Address in Any State to See All Associated Public Property Records.

Historical Overview of Utahs Property Taxes. TAP includes many free services such as tax filing and payment and the ability to manage your account online. 1 of the payment amount with a minimum fee of 100.

Please contact us at 801-297-2200 or. The amount you need to pay at the time of vehicle registration varies depending on vehicle type fuel type county and other factors. Sorry this page is under maintenance and will be.

Motor Vehicle Taxes Fees. For security reasons TAP and other e-services are not available in most countries outside the United States. Filing Paying Your Taxes.

See also Payment Agreement Request. It does not contain all tax laws or rules. You can also pay online and.

Change Your Mailing Address. See Results in Minutes. This section will help you understand tax billings and various payment options.

The Recorders Office and the Surveyors Office records the boundaries and ownership. Tobacco Cigarette Taxes. Payments can be made online by e-check ACH debit at taputahgov.

You will receive your tax license information by postal mail after which you can go to Taxpayer Access Point taputahgov and create a TAP login to file and pay your taxes online. 0 Electronic check payment. Form of Payment Payment Types Accepted Online.

See Taxpayer Access Point TAP for electronic payment options including. Steps to Pay Your Property Tax. Municipal Certifications County Boundaries Annexations.

Online REAL Estate Property Tax Payment System.

Property Taxes Sandy City Ut Official Website

Property Taxes Sandy City Ut Official Website

Alameda County Ca Property Tax Calculator Smartasset

Median Household Income And Taxes State Tax Levels In The United States Wikipedia Ricevimenti Valutazione

Use Smartasset S Utah Paycheck Calculator To Calculate Your Take Home Pay Per Paycheck For Both Salary And Hourly Retirement Calculator Property Tax Financial

States Where Residents Are Most Satisfied Estate Tax Inheritance Tax Inheritance

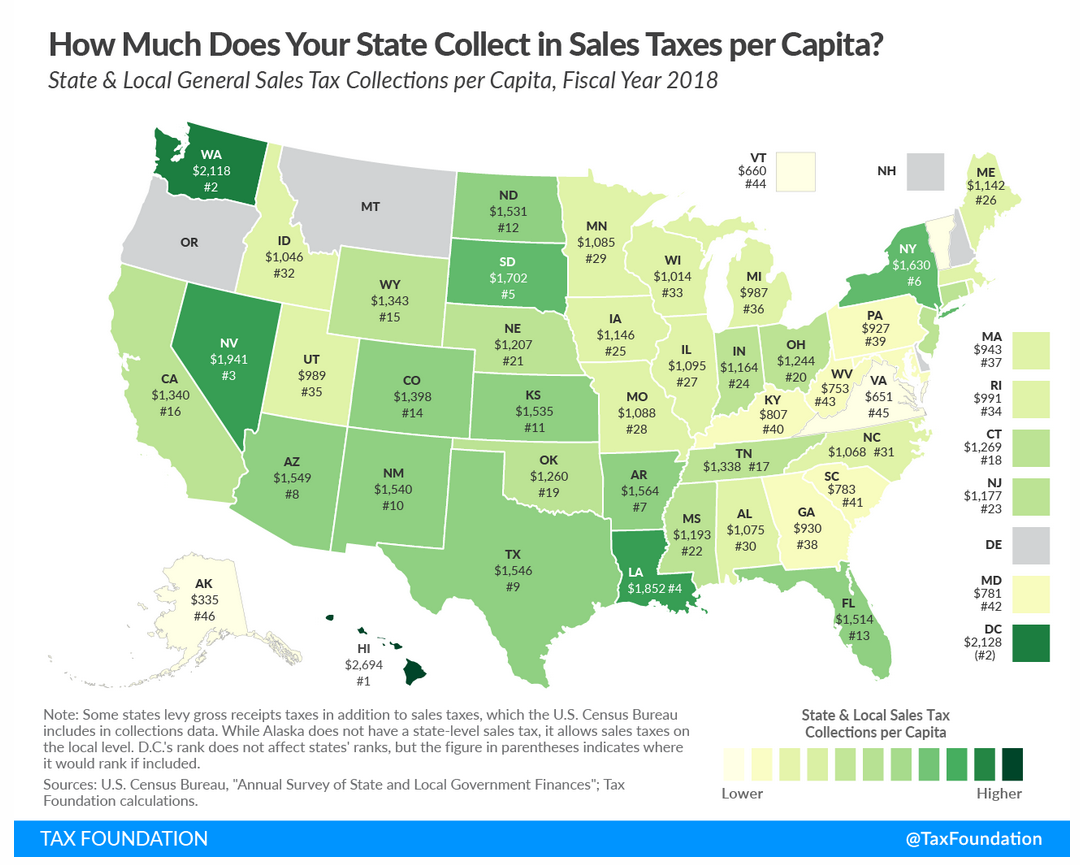

States With Highest And Lowest Sales Tax Rates

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

How Do State And Local Sales Taxes Work Tax Policy Center

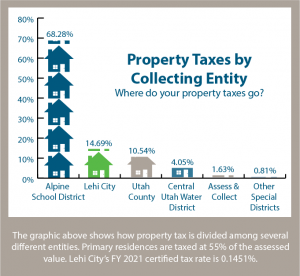

Utah Collected 989 Annually From Each Resident In Sales Taxes According To New Study Utah Taxpayers

Property Taxes On Single Family Homes Rise Across U S In 2021 Attom

State Income Tax Rates Highest Lowest 2021 Changes

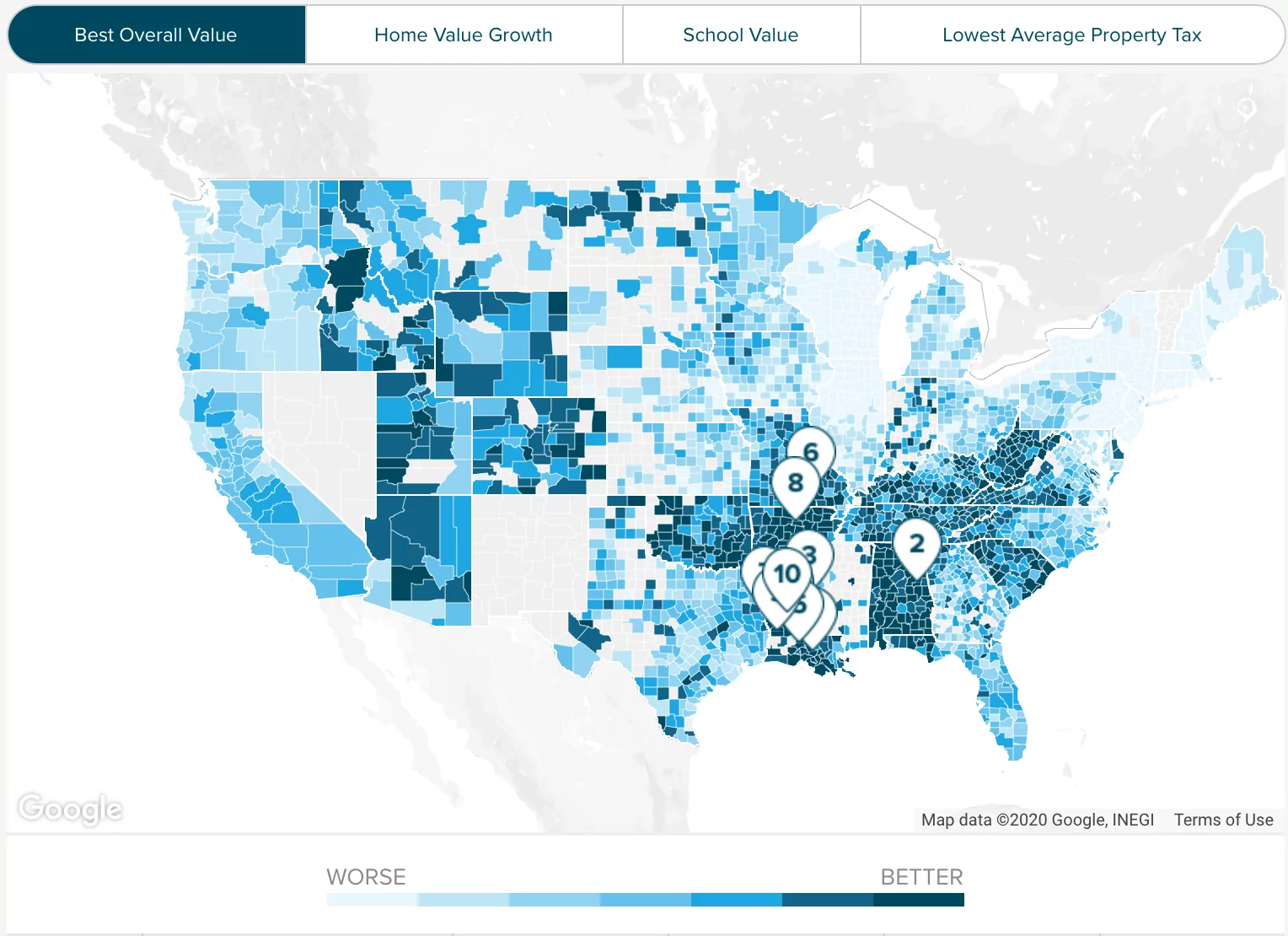

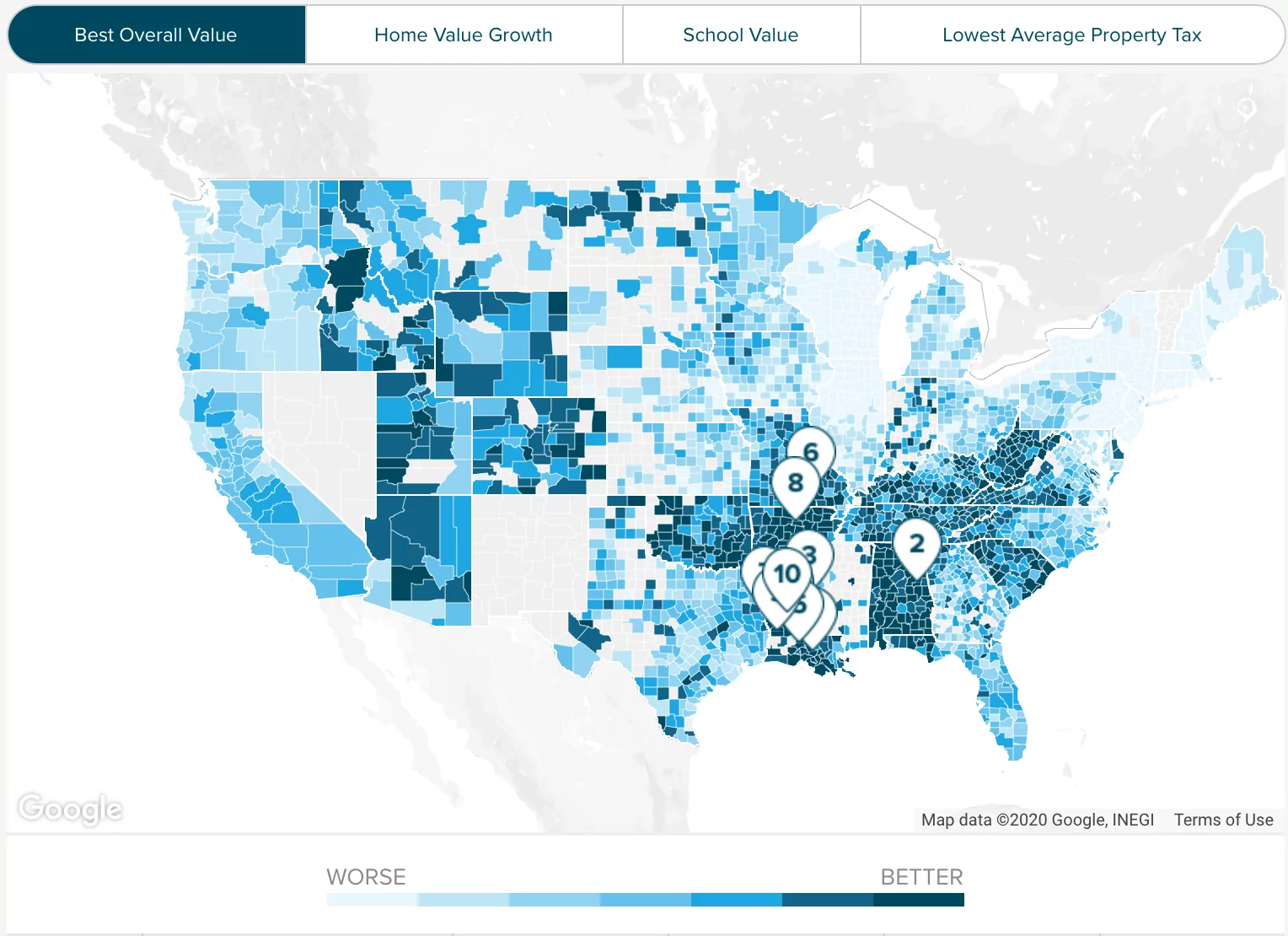

2022 Property Taxes By State Report Propertyshark

Utah Property Taxes Utah State Tax Commission